While it’s uncertain how the COVID-19 pandemic will further reshape the future of industries, taking a look at developing trends will set companies toward a sensible direction.

New Nutrition Business which offers expert consultancy services to agriculture, ingredient and branded product companies on all aspects of nutrition and health, focusing on concrete, implementable strategies, came up with a guide for companies who are navigating the coronavirus crisis.

Consumers are taking to baking in a big way – mostly banana bread – and flour is disappearing from supermarket shelves as soon as they’re restocked. Sales of vitamin C-rich oranges are up and consumers are increasingly searching online for probiotics for immunity.

It’s little surprise that food companies are wondering what coronavirus will mean for levels of demand and for consumption patterns in the future.

“From Australia to America, Portugal to Scotland, companies have been contacting us to ask what they should be thinking about, what are the lasting changes are that being wrought by the pandemic, and what they might mean for their strategies,” says Julian Mellentin, food industry expert and director of consultancy New Nutrition Business.

In a new report, Food & nutrition strategy in a coronavirus world – 20 questions to help shape your strategy, Mellentin sets out, and responds to, the most common questions including:

· Will there be fewer brands and fewer start-ups?

· What will happen to the big consumer trends?

· Will local become more important?

· Will packaging stage a comeback?

· Is there a place for indulgence?

· Will immunity dominate NPD and innovation?

“Immunity is certainly coming back as a significant consumer interest in the west (although in Asia it never went away),” says Mellentin.

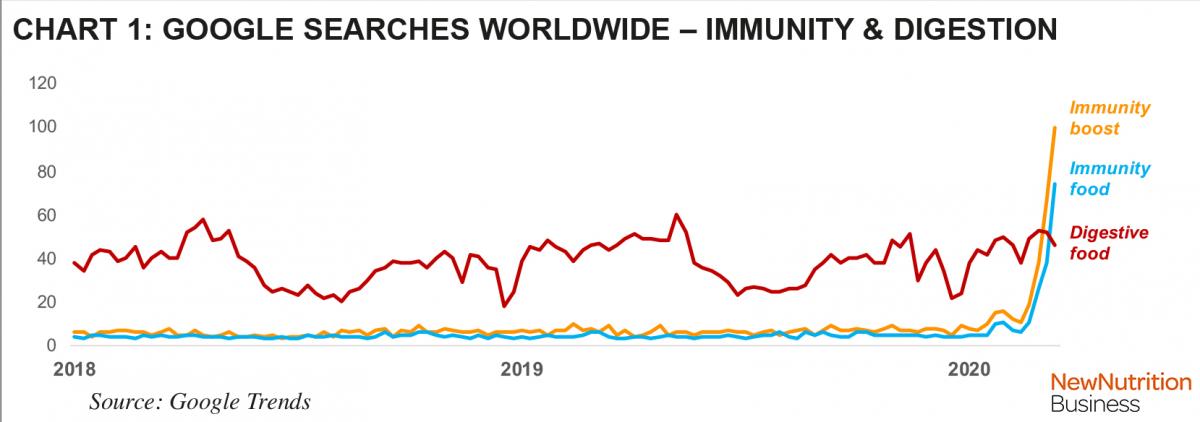

As the chart shows, consumers’ Google searches for immunity were flat for a long time, and always lower than popular subjects such as digestive health. But recently there has been a surge in consumer searches that use terms such as “immunity boost” and “immunity foods”.

Among foods and ingredients there will be both winners and losers. “In the short term (12-18 months) the biggest winners are likely to be any ingredients that support the microbiome – and particularly probiotics – and any nutrient or food that has an established link with immunity in people’s minds,” Mellentin says.

“Consumer motivation to boost their immune health has for many years been an element in the success of many products in Asia, such as chicken broth and kiwifruit (Zespri, the world’s biggest kiwifruit grower, markets its fruit in Asia for its immune-boosting high content of vitamin C).

“Covid-19 has now provided a sharp reminder to western consumers, too, that there are good reasons to carefully choose items that contribute to the health and well-being of the individual and the family.”

“There has never been a more promising future for immunity and probiotics,” Mellentin adds.

Product developers also need to monitor what solutions are being proposed on social media. Influencers are often as powerful as traditional beliefs – as seen by the recent surge of interest in elderberry, which has enjoyed a 137% increase in Google searches. Among internet influencers it has been one of the most-mentioned “foods for immunity”.

There are also strong growth prospects for plant-based. “There was a surge of interest on Instagram and other social media about plant-based in March 2020, illustrating that the already-positive image of fruits and vegetables will continue to benefit,” says Mellentin.

Mellentin’s report doesn’t set out to predict exactly what is going to happen or what companies must do – as the global pandemic steadily morphs into an economic crisis, no one can forecast the future with any certainty. Its purpose is to:

· set out what the most likely impacts on strategy will be

enable companies to think in a structured way about what might change for their business, and how their strategy should evolve to respond to the changes. It includes several “what does it mean for business” check-lists to help companies large and small to think through the next 12-18 months.

Fashion & Celebrity News