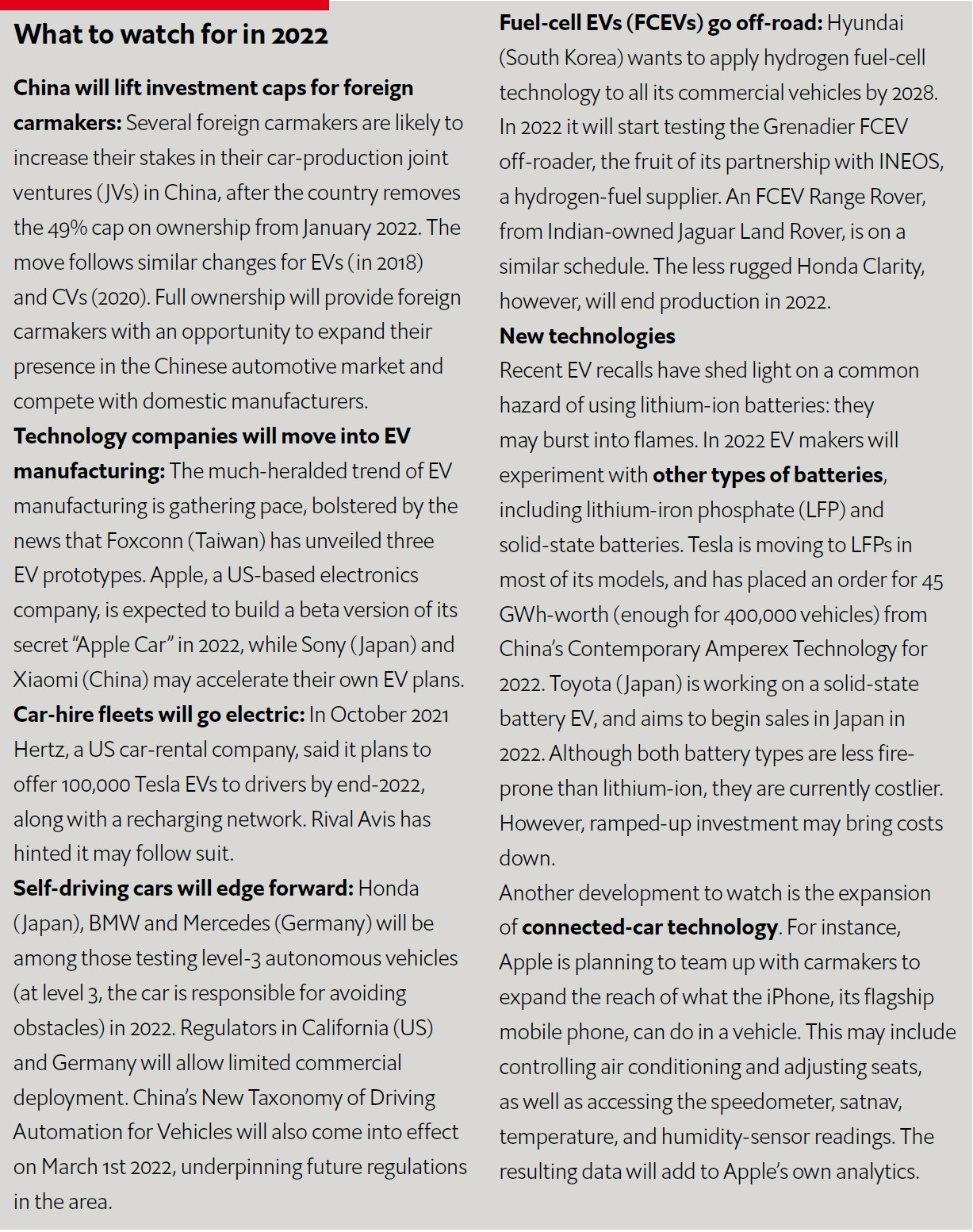

Recovery in global automotive markets will continue in 2022, with new-vehicle sales racking up similar growth rates to those of 2021. EIU expects new-car sales to rise by 7.8%, year on year, while sales of new commercial vehicles (CVs) will increase by 7.1%. This will take total sales back past 2019 levels, reversing the pandemic-induced slump of 2020.

However, the extent of the rebound will vary widely by region, depending on the pace of the economic recovery, as well as the depth of the slump they have endured. Indeed, new-vehicle sales in North America and Asia have already regained the ground they lost in 2021. In 2022, it will be the turn of the Middle East and Eastern Europe, but Western Europe and Latin America will have to wait until 2023 to return to pre-pandemic levels. China alone will account for 30% of sales in 2022 (although its share has fallen from 33% since 2020), while the US will take 19%.

Supply-chain bottlenecks will widen

the demand-supply gap

Supply-chain bottlenecks will widen

the demand-supply gap

The global recovery in vehicle sales will be dampened by supply-chain volatility in the automotive industry. A global shortage of semiconductors, a key automotive component, will continue to hit automakers’ ability to service rebounding demand. We expect the chip crunch to last well into 2022, before easing in the last six months. We are also expecting prolonged shortages of magnesium, an essential component for producing aluminium alloys used in vehicles. Production in China, which accounts for 87% of global supply, is being affected by power shortages that could extend throughout the first quarter of 2022. In addition, EV makers are running short of lithium and cobalt, which are crucial for battery manufacturing.

The widening demand-supply gap will push up the prices for new as well as used car models, and will result in long waiting periods for customers. Mercedes-Benz (owned by German manufacturer Daimler) says some of its buyers will have to wait more than a year for their models to be delivered. By then, investment into production of these commodities should start to yield results, and prices will start to fall quickly in response.

EV sales will continue to soar

The one bright spot for automotive during the pandemic was EV sales, which grew by 42%, even as global automotive markets shrank. Growth accelerated still further in 2021, forcing us to raise our forecasts, but will slow slightly in 2022 as the base for comparison rises. Even so, we expect new-EV sales to rise by 51% worldwide, accounting for around 9% of total new-car sales. In summary, EVs are finally becoming serious market disruptors.

The market will continue to be dominated by China and Europe, accounting for around 80% of sales between them. However, the US is catching up rapidly. In August, the US government announced a non-binding goal to make EVs account for half of new-vehicle sales by 2030. In 2022, if legislation is approved, it will start implementing a US$174bn investment programme to make that happen.

Governments will raise long-term targets for clean vehicles

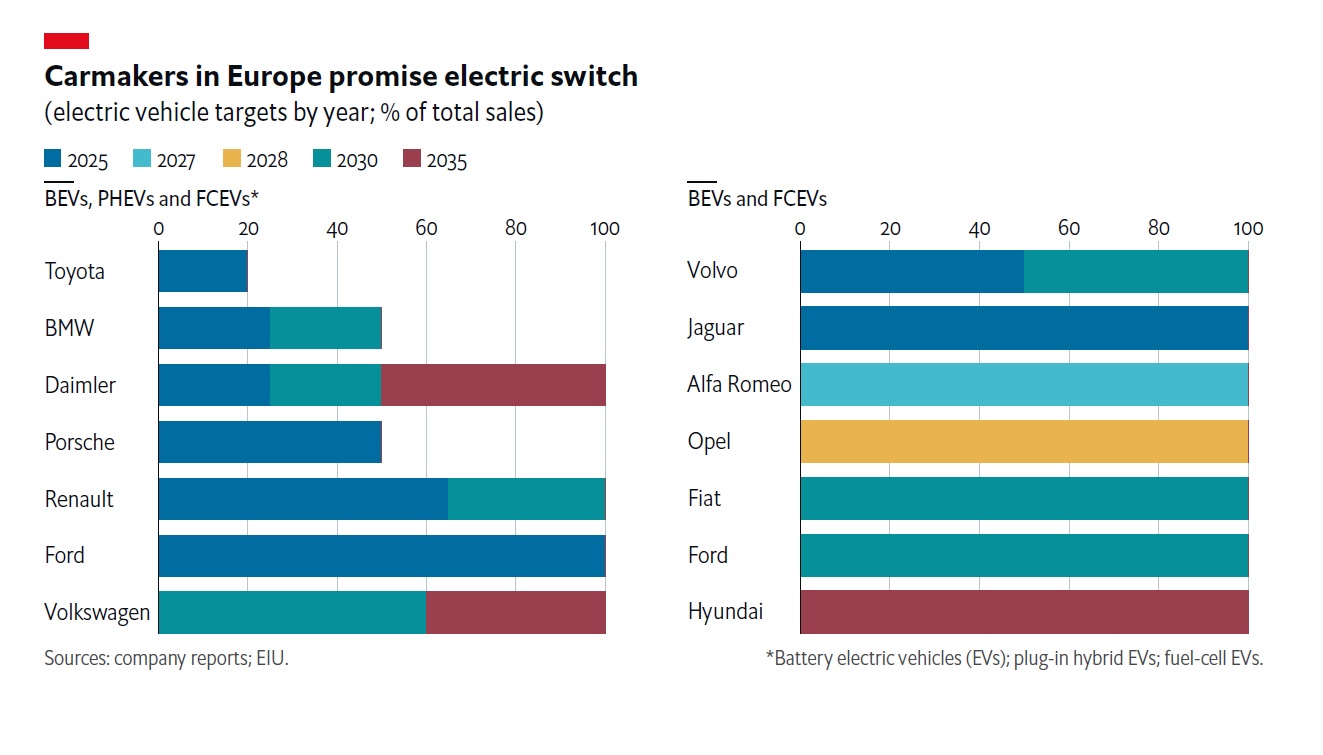

In 2022 we expect governments across the world to set more stringent regulations to reduce transport emissions. These will include measures to accelerate the adoption of EVs and more deadlines for the phase-out of internal combustion engines (ICE). As a result, we expect carmakers to expand their EV launch plans.

The US Environmental Protection Agency (EPA) has already proposed tougher vehicle-fuel economy standards for passenger cars and light trucks for model years 2023-26, reversing standards set by the previous administration. These regulations are likely to be finalised by early 2022. The EPA also plans to finalise the Clean Trucks Plan in 2022, which aims to reduce emissions from new heavy-duty vehicles starting with model year 2027. Meanwhile, the European Commission’s ‘Fit for 55’ proposal calls for the phase-out of ICE vehicles by 2035. The EU will also extend its Emissions Trading System (EU ETS) to cover road transport.

As is the case with existing fuel-efficiency rules, these requirements are likely to be most stringent in developed countries. This opens up a dilemma for carmakers about whether to retire their fossil-fuel models entirely, or to shift these production and sales operations to developing countries. We do not, for example, expect EV sales in India to reach over 50% of the new-car market until around 2040. Given the long timelines involved in retooling plants, some of those decisions over future production will have to be made in 2022.