The Philippine government's efforts to improve public access to contraceptives and family planning have triggered a decline in childbirth rates, which is expected to lead to a decrease in the overall volume and value of sales of baby food in the country. Rising inflation will further constrain spending on baby food products in the immediate future. As a result, the Philippines’ baby food sector is projected to decline to PHP42 billion ($826.7 million) by 2028, registering a negative compound annual growth rate (CAGR) of 4.5% over 2023-2028, says GlobalData, a leading data and analytics company.

(Photo © Tycoon751 I Dreamstime.com)

GlobalData’s report, ‘Philippines Baby Food - Market Assessment and Forecasts to 2028’ reveals that baby milk was the largest category in terms of value and volume in 2022. All categories are forecast to decline in value and volume terms over 2022–28.

Shraddha Shelke, Consumer Analyst at GlobalData, comments: “Demographic changes taking place with respect to the baby population and live birth rates, and the government’s measures to restrict the number of births coupled with an increase in the number of working women will contribute to a decline in the Philippines’ baby food market.”

However, in a GlobalData survey, 47% of respondents stated that they spent a very/quite high amount on baby milk in Q4 2022*, despite a rise in inflation and bleak economic conditions in the country. Similarly, 43% of respondents claimed that they spent a high amount on purchasing baby food*.

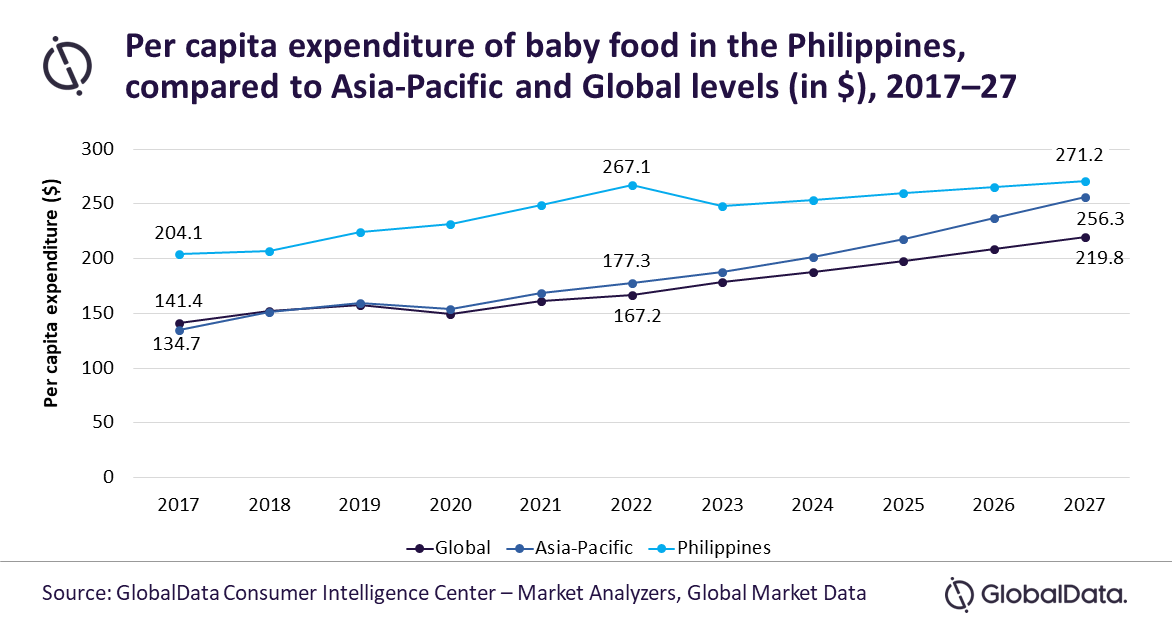

Owing to the high inclination for high-quality products, the per capita expenditure (PCE) on baby food in the Philippines increased from $204.1 in 2017 to $267.1 in 2022, surpassing both the regional level ($177.3) and the global level ($167.2).

In December 2022, the impact of inflation was severely felt by Filipinos as food and energy prices reached their highest levels since 2008 in the country. With high inflationary pressures expected to continue in 2023, the cost-of-living crisis will undermine sales of premium products in the immediate future.

“However, as the economy rebounds in the upcoming years, consumer spending on baby food is set to recover in terms of value sales. As a result, the Philippines’ PCE on baby food is projected to reach $271.2 by 2027,” says Shelke.

Hypermarkets & supermarkets was the leading distribution channel in the Philippines baby food market in 2022, followed by convenience stores and drugstores & pharmacies. Nestlé, Mead Johnson (Reckitt Benckiser), and Abbott Laboratories were the top three leading companies in the country's baby food sector in 2022.

Shraddha concludes: “The Philippine baby food market’s growth is tied to the economic fortunes of the country. The rising disposable income of Filipino families with babies will stimulate sales of premium and organic baby food products. To build a stable consumer base in the country amid changing demographic conditions, manufacturers should focus on offering affordable premium baby food products with value-added benefits."

*GlobalData 2022 Q4 Consumer Survey – the Philippines, with 369 respondents, published November 2022, High includes very high and quite high, low includes very low and quite low